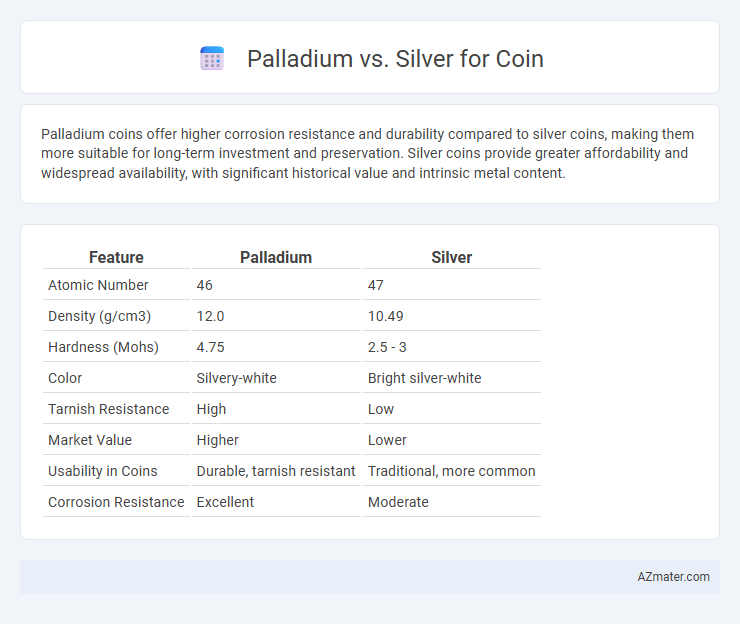

Palladium coins offer higher corrosion resistance and durability compared to silver coins, making them more suitable for long-term investment and preservation. Silver coins provide greater affordability and widespread availability, with significant historical value and intrinsic metal content.

Table of Comparison

| Feature | Palladium | Silver |

|---|---|---|

| Atomic Number | 46 | 47 |

| Density (g/cm3) | 12.0 | 10.49 |

| Hardness (Mohs) | 4.75 | 2.5 - 3 |

| Color | Silvery-white | Bright silver-white |

| Tarnish Resistance | High | Low |

| Market Value | Higher | Lower |

| Usability in Coins | Durable, tarnish resistant | Traditional, more common |

| Corrosion Resistance | Excellent | Moderate |

Overview of Palladium and Silver Coins

Palladium and silver coins differ significantly in rarity and market value, with palladium coins being much rarer and typically more expensive due to their limited supply and industrial demand. Silver coins have a long history of use in currency and are widely respected for their liquidity and affordability, making them popular among collectors and investors. Both metals offer unique advantages, with palladium known for its corrosion resistance and high density, while silver is prized for its conductivity and widespread accessibility.

Historical Use in Coinage

Silver has been a primary metal for coinage for millennia, valued for its durability, rarity, and widespread acceptance in trade from ancient civilizations to modern economies. Palladium, discovered in the 18th century, has seen limited historical use in coinage due to its rarity and higher cost, primarily appearing in modern commemorative and investment coins. Silver's extensive historical use contrasts with palladium's niche role, reflecting their differing availability and economic importance in numismatic history.

Rarity and Availability

Palladium coins are significantly rarer than silver coins due to the limited global supply of palladium, primarily sourced from a few mining regions like Russia and South Africa. Silver coins are more widely available and produced in larger quantities as silver is more abundant and less expensive compared to palladium. The scarcity of palladium enhances its value and collectibility in coin markets, whereas silver remains a more accessible option for everyday investors and collectors.

Physical and Chemical Properties

Palladium coins possess a higher density (12.02 g/cm3) compared to silver coins (10.49 g/cm3), resulting in a heavier feel for the same volume. Chemically, palladium exhibits exceptional resistance to tarnishing and corrosion due to its inertness, whereas silver is prone to oxidation, leading to surface darkening over time. Palladium's melting point (1554.9degC) surpasses that of silver (961.8degC), contributing to greater durability and longevity in coinage.

Investment Potential and Market Trends

Palladium coins exhibit higher investment potential due to limited global supply and increased industrial demand, driving their prices upward more consistently than silver. Silver coins offer affordability and liquidity, benefiting from a well-established market and strong historical usage as a store of value. Market trends indicate growing interest in palladium for its scarcity, while silver remains a preferred choice for diversification and hedging against inflation.

Pricing and Value Fluctuations

Palladium coins generally exhibit higher price volatility compared to silver coins due to palladium's smaller market size and heavy industrial demand, particularly in the automotive sector. Silver coins tend to have more stable pricing influenced by both investment demand and industrial use, with historical data showing gradual value appreciation over time. Investors often consider silver coins a safer, more liquid asset, while palladium's fluctuating value can offer higher short-term gains but with increased risk.

Industrial and Practical Applications

Palladium coins are prized for their exceptional corrosion resistance and catalytic properties, making them valuable in automotive catalytic converters and electronics industries. Silver coins, while also durable, are widely recognized for their superior electrical conductivity and antimicrobial properties, leading to extensive use in electronics, medical instruments, and solar panels. The industrial significance of palladium lies in its catalytic efficiency, whereas silver's key advantage is its versatility in practical applications requiring conductivity and antimicrobial characteristics.

Advantages of Palladium Coins

Palladium coins offer superior durability and resistance to tarnishing compared to silver coins, making them ideal for long-term investment and collection. They possess a higher rarity and market value, enhancing their appeal as a precious metal asset. Palladium's unique chemical properties also provide excellent corrosion resistance, ensuring the coin's appearance remains pristine over time.

Advantages of Silver Coins

Silver coins offer superior affordability compared to palladium, making them accessible to a broader range of investors and collectors. Their high liquidity and established global demand ensure easy resale and a stable market value. Silver's historical significance and chemical stability also contribute to its long-term appeal as a tangible investment.

Choosing Between Palladium and Silver Coins

Choosing between palladium and silver coins depends on investment goals, market volatility, and rarity. Palladium coins offer higher value due to limited supply and industrial demand, making them a strategic choice for high-risk, high-reward portfolios. Silver coins provide affordability and liquidity, favored for budget-friendly investing and broader market accessibility.

Infographic: Palladium vs Silver for Coin

azmater.com

azmater.com