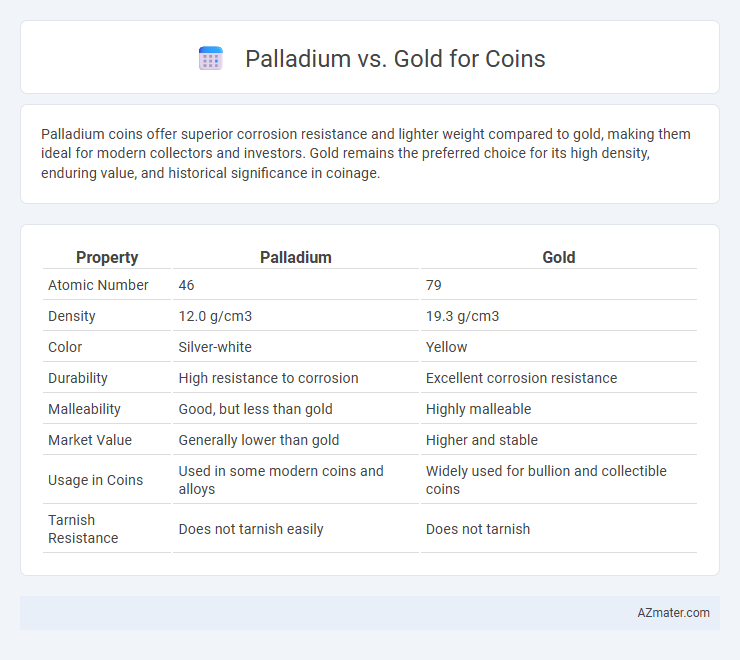

Palladium coins offer superior corrosion resistance and lighter weight compared to gold, making them ideal for modern collectors and investors. Gold remains the preferred choice for its high density, enduring value, and historical significance in coinage.

Table of Comparison

| Property | Palladium | Gold |

|---|---|---|

| Atomic Number | 46 | 79 |

| Density | 12.0 g/cm3 | 19.3 g/cm3 |

| Color | Silver-white | Yellow |

| Durability | High resistance to corrosion | Excellent corrosion resistance |

| Malleability | Good, but less than gold | Highly malleable |

| Market Value | Generally lower than gold | Higher and stable |

| Usage in Coins | Used in some modern coins and alloys | Widely used for bullion and collectible coins |

| Tarnish Resistance | Does not tarnish easily | Does not tarnish |

Introduction to Palladium and Gold Coins

Palladium and gold coins both serve as valuable investment assets with distinct properties. Palladium coins are prized for their rarity, high industrial demand, and brilliant silvery-white appearance, offering diversification beyond traditional gold holdings. Gold coins remain a timeless store of value with exceptional liquidity, recognized worldwide for their stability and historic role in wealth preservation.

Historical Use of Palladium and Gold in Coinage

Palladium and gold have distinct histories in coinage, with gold being used for millennia due to its rarity, durability, and intrinsic value, serving as a standard for currencies in ancient civilizations such as Egypt and Rome. Palladium's use in coins is relatively recent, gaining popularity in the 20th century, particularly after its discovery in 1803 and its application in modern bullion coins due to its scarcity and resistance to tarnish. While gold remains a traditional symbol of wealth and stability in coinage, palladium offers a niche alternative, especially favored in limited edition and collectible coins.

Physical and Chemical Differences

Palladium coins are lighter and have a lower density (12.02 g/cm3) compared to gold coins with a density of 19.32 g/cm3, making palladium easier to carry and handle. Chemically, palladium is a member of the platinum group metals, exhibiting superior resistance to oxidation and corrosion, whereas gold, though highly inert, can still develop a patina over time. Palladium's higher melting point of 1554degC contrasts with gold's 1064degC, affecting coin minting processes and durability under high-temperature conditions.

Investment Value Comparison

Palladium coins typically offer higher volatility and potential for rapid gains compared to gold coins, which are favored for their long-term stability and consistent demand in investment portfolios. Gold coins hold intrinsic value backed by centuries of market trust, making them a safer hedge against inflation and economic uncertainty. Palladium's industrial demand, driven largely by automotive catalytic converters, can lead to fluctuating prices, while gold's limited industrial use emphasizes its role as a reliable store of wealth.

Market Demand and Liquidity

Gold coins consistently demonstrate higher market demand and superior liquidity compared to palladium coins, driven by gold's status as a universal store of value and widespread acceptance in global markets. Palladium coins attract niche investors due to limited supply and industrial applications, yet their market depth and trading volumes are significantly lower. Investors seeking quick resale and broad market access typically favor gold coins for their ease of liquidation and well-established secondary markets.

Price Volatility and Stability

Palladium exhibits significantly higher price volatility compared to gold, often driven by industrial demand and supply constraints, making it a riskier asset for coin investors seeking stability. Gold maintains a more stable and consistent value due to its historical role as a safe-haven asset and broader market acceptance. Investors prioritizing price stability and long-term preservation of wealth generally favor gold coins over palladium.

Rarity and Availability

Palladium is significantly rarer than gold, with annual global production around 200 metric tons compared to gold's approximately 3,000 metric tons, making palladium coins more scarce and typically harder to find. The limited availability of palladium is driven by its primary use in automotive catalytic converters and industrial applications, whereas gold is widely mined and stockpiled for investment and minting purposes. This rarity translates to higher premiums and more volatile pricing for palladium coins compared to gold coins, which enjoy more stability and liquidity in the market.

Industrial and Collectible Uses

Palladium coins gain value primarily from industrial demand in automotive catalytic converters and electronics, while gold coins retain enduring appeal due to their historical significance and stability as a collectible and investment asset. Gold's rarity and intrinsic luster make it a preferred choice for numismatic collections and long-term wealth preservation. Palladium's volatility compared to gold reflects its dual role as both an industrial metal and a niche collectible, influencing market prices and collector interest.

Storage and Durability Considerations

Palladium coins offer superior resistance to tarnish and corrosion compared to gold, making them ideal for long-term storage without requiring frequent maintenance. Gold coins, while softer and more prone to scratches, have a storied history as a durable and stable store of value due to their chemical inertness and density. Both metals require secure, climate-controlled environments, but palladium's hardness provides enhanced protection against physical wear during handling and transport.

Conclusion: Choosing Between Palladium and Gold Coins

When deciding between palladium and gold coins, consider palladium's rarity and higher industrial demand, which can lead to more volatile price movements compared to gold's long-established status as a stable store of value. Gold coins offer liquidity, timeless appeal, and a robust historical track record for wealth preservation, making them a preferred choice for risk-averse investors. Palladium coins appeal to those seeking portfolio diversification and potential appreciation linked to automotive and industrial markets, but carry higher market risk.

Infographic: Palladium vs Gold for Coin

azmater.com

azmater.com